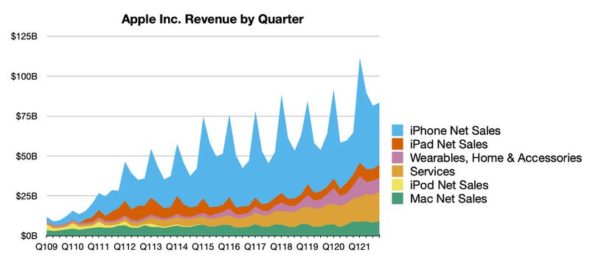

A few days ago, Apple announced its financial results for the fourth fiscal quarter of 2021, which corresponds to the third quarter of the year. The results were good, as Apple achieved a revenue growth of 28.8% on a quarterly basis and 33.25% on an annual basis. Despite this, Apple's stock declined in the market, due to the fact that the returns were less than press expectations. In the following lines, we get to know the results in detail, and were they really frustrating?

Before we move on to discussing the details, let's quickly get acquainted with what Apple said in its results statement a few days ago, in which Tim Cook justified the decline in results compared to expectations, as he said: “Our performance was very strong despite greater than expected supply constraints, which we estimate at about 6 billion Dollars, supply constraints have been driven by the much talked about industry-wide chip shortage, other than the COVID-related manufacturing disruptions in Southeast Asia.

However, the company's overall revenue remained high at 29% and each of its product categories grew year on year.

Apple reported revenue of $83.36 billion and quarterly net profit of $20.6 billion, compared to revenue of $64.7 billion and quarterly net profit of $12.7 billion. In the same quarter of last year.

The gross margin for this quarter was 42.2% compared to 38.2% in the same quarter of last year. Apple also announced a quarterly dividend of $0.22 per share, to be paid on November 11 to shareholders of record effective November 8.

For the full fiscal year, it was $365.8 billion in sales and $94.7 billion in net income, up from $274.5 billion in sales and $57.4 billion in net income for fiscal 2020.

The results of the fourth fiscal quarter of this year compared to expectations

The results of the fourth fiscal quarter of this year compared to expectations and compared with Apple's performance in the same quarter last year.

◉ earnings per share: $1.24 vs. $1.24 expected.

◉ Revenues: $83.36 billion versus $84.85 billion expected, up 29% year-over-year.

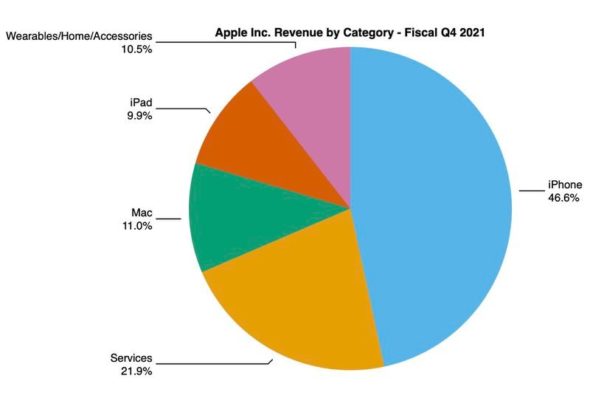

◉ IPhone revenues: $38.87 billion versus $41.51 billion expected, up 47% year over year.

◉ Revenue from services: $18.28 billion versus $17.64 billion expected, an increase of 25.6% year-on-year.

◉ Other product returns: $8.79 billion versus $9.33 billion expected, up 11.5% year over year.

◉ Mac revenue: $9.18 billion versus $9.23 billion expected, up 1.6% year over year.

◉ IPad Revenue: $8.25 billion versus $7.23 billion expected, up 21.4% year over year.

◉ Gross margin: 42.2% vs. 42.0% expected.

◉ iPhone sales rose 47% year-on-year, but still below Wall Street expectations.

Apple also did not provide official guidance this quarter, and this has been the case since the beginning of the Corona epidemic, but Cook said that Apple expects strong year-over-year revenue growth in the December quarter, despite the fact that he said that the company will face worse constraints in its supply lines. Higher than $6 billion in damages from revenue. However, he says the December quarter will be the company's largest in terms of revenue in its history.

CFO Luca Maestri said on a call with analysts that iPad sales will decline year-over-year in the December quarter due to supply constraints while other product categories will grow. And there is a significant improvement in manufacturing disruptions related to Covid.

“Chip shortages persist, and the supply issues were related to Old Testament chips and manufacturing technologies, rather than the more advanced processors recently introduced by Apple,” Cook said.

Year-on-year sales growth forecasts indicate that Apple sees much more demand for iPhone 13 models than can be supplied. Apple's last quarter included iPhone 13 sales for only a few days, ending on September 25.

It is worth noting that Apple is currently experiencing tremendous growth, as sales of iPhone, iPad and Mac devices have spread despite the epidemic, with annual revenue for the fiscal year 2021 increasing by 33% from 2020 to $ 366 billion.

Services sector

The strongest growth in Apple's product categories apart from the iPhone was in the services sector, which includes sales from the App Store, music and video subscription services, advertising, extended warranties, and licenses. Apple services grew 26% annually, which Cook said was higher than the company had expected.

Cook said Apple has 745 million paid subscriptions, which include not only first-party services like Apple Music but also subscriptions through the Apple App Store, and that's up 160 million year-over-year, a five-fold increase in five years.

Other products

◉ Macs didn't have strong growth, only increasing 1.6% annually, but the quarter did not include sales of new MacBook Pro models announced in October.

◉ iPad devices grew by 21% year-on-year, despite supply constraints.

◉ The other product category, which includes Apple Watch models and AirPods, grew 11% without the new products that went on sale in October.

It's the first time Apple has failed to beat earnings expectations this quarter since April 2016, and the first time since May 2017 that Apple's revenue has beat expectations, according to Refinitiv data.

Comment iPhone Islam

Actually, the conclusion of the year’s results for Apple was strong, and Apple achieved in the 2021 fiscal year ending on September 30, its strongest results in its history, with total revenues of $ 365 billion. in Mac, 2021% in iPad, 2020% in wearable devices, and 39.33% in services. That is, everything achieved growth.

The world is severely affected by the chips crisis. TSMC is the largest chip manufacturer in the world, producing more than 75% of the world's production; Some expected that Apple would not be affected specifically by this crisis, because 20-25% of TSMC's revenues come from Apple, and thus Apple alone represents a quarter of the Taiwanese company's revenues and the whole world with all phone, car, technology and even arms companies represents the remaining three quarters; Some expected that Apple would have preferential treatment “and it may have already happened,” but the crisis is greater than everyone’s ability and it is time to hit even Apple, which reports now say it has decided to reduce the production of the iPad in order to provide resources for the production of the iPhone 13.

Source:

11 comment